Hey everyone - welcome to the 91st edition of The SEG3 Report, and the first of 2026. We hope you all had a wonderful holiday season!

For this week’s edition: We’re going to dive into FIFA’s gaming partnerships & strategy, Deloitte’s fandom research, and TikTok & Reddit’s influence on Gen Z - all through the lens of how these stories tie into the new fan journey.

Let’s get into it ⤵️

Defining, building and measuring fandom

A stat I have burnt into my brain is that “50% of fans form their fandom by age 14”.

Combine that with one of the main takeaways from SEG3 LA being that “the real bottleneck is now discovery, attention & distribution”, and it becomes obvious why getting the early ingredients right matters so much. Because if fandoms are forming young, and attention is harder to capture than ever, then relevance may well be decided long before fans ever reach an owned channel.

But before we look at where fandom is going, and the mediums or platforms that attention is accumulating around, it’s worth grounding ourselves in what the data actually says today. Deloitte’s latest research gives a useful baseline for the characteristics and benefits of fandom, these being:

Identity

“Younger consumers are more likely to say their fandoms are central to their identity” - reinforcing why early discovery and cultural relevance matter so much.Influence

Fandoms are inherently social - with fans actively influencing peers, introducing them to complementary interests and passion points, and shaping what others watch, buy and care about.Value to your organisation

Understanding what’s driving engagement and influence can help you to know what levers you need to pull to drive behaviours and purchasing decisions.Value to your partners & ecosystem

A deeper understanding of your fan, their behaviours and interests helps you to source and integrate brands and IP more seamlessly into your ecosystem.

It lines up with what we talked about in our last edition of 2025; that fandom can’t be built transactionally - instead, it’s got to be participatory, emotion-led and nurtured continuously.

And that means in today’s fragmented attention landscape, the winners will be those that intensely understand the fan journey, and how fans can and are moving from first discovery to long-term loyalty.

Which brings us to how that journey is already playing out in practice…

The power of platforms for discovery & community

If fandom compounds over time, then the first discovery is where the biggest gains (or losses) are made.

And given creation is no longer a bottleneck (thanks to AI and other content creation tools), those first discoveries are far less likely to happen through official channels alone. Anyone can now publish about their passions - and increasingly, it’s performing at the same level as official channels.

TikTok’s Sports Messaging Research 2025 found that there’s now not much disparity between engagement with content from:

Official accounts (64%)

Creators (63%)

Fan-generated content (60%).

In other words, relevance in today’s world is no longer necessarily dictated by who owns the rights, but by who best understands the platform, the format and the culture. That’s why UGC-first platforms focused on discovery like TikTok have become so powerful, and “why creators have become not just amplifiers of marketing moments, but the centre of the experience”.

But discovery is just one part of the puzzle.

For people to stick around, they need more than just moments or clips; they need to build connection, and feel like they are part of a community.

So as the fans interest in their passion point deepens, they want to find spaces where they can connect with others that share the same identity, and that’s where more community-driven platforms or initiatives meet the need.

A recent piece this week in The Guardian talks about this shift - with Reddit now becoming the fourth most visited site, overtaking TikTok in the UK, and Gen Z were reportedly the driver of this.

Why? Because it’s human nature to look for connection (and perhaps now imperfection given the rise of AI content) amongst the noise and infinite content that discovery platforms now offer.

The generation often labelled as having ‘low-attention spans’ actively seeking out spaces built for discussion should be a big signal to everyone that whilst youth audiences are brutal in deciding what gets their attention (and what doesn’t), they’re extremely willing to go deep once an interest has been built.

There’s no question in my mind that this creates a significant opportunity for brands across sports, entertainment, gaming & music. These are brands that are built on a bedrock of fans rather than customers, and are essentially community assets. This means they’re uniquely positioned to offer identity and belonging to audiences that have grown up with almost everything else feeling ‘fleeting’.

A good example of audiences seeking depth is that the Premier League’s subreddit generated more than a billion views in the last year alone. Incredible numbers.

But sole reliance on platforms is a dangerous game. While discovery and community increasingly happen on third-party platforms, the value they create doesn’t always accrue to the IP itself.

And so for brands built on fandom, the challenge (and the opportunity) is figuring out how to meet fans where they already are, while still bringing them closer into an ecosystem they can actually own.

So, how is one of the biggest rights holders in the world, FIFA, finding this balance?

FIFA’s gaming strategy

It’s World Cup year; a cultural moment perhaps only rivalled by the Olympics. Over the summer, FIFA will have much of the globe’s attention - but, the question will be how can that attention, and the fandom that comes with it, be built pre-tournament, and sustained after it ends?

Well, this is where interactive experiences and storytelling start to earn their keep.

And over the past couple of weeks, FIFA have made two notable moves as part of their gaming strategy, both designed to allow fans to continue engaging with the IP well before and after the tournament.

The first, a partnership with Netflix & Delphi Interactive to deliver a simulation game - filling the gap in FIFA’s portfolio left by EA Sports.

The second mirrors the path taken by the NFL with Universe Football, where they have now integrated FIFA IP into Gamefam’s popular Super League Soccer experience on Roblox - now rebranded FIFA Super Soccer.

Both partnerships ultimately do the same thing - creating more opportunities for fans to interact with and immerse themselves in the FIFA IP using two of the biggest platforms on the planet; Netflix & Roblox.

These new pieces of the portfolio, alongside Mythical Games’ FIFA Rivals, Enver Studio’s FIFA Heroes & Sports Interactive’s Football Manager, all deliver for different gameplay styles, geographical locations (from FIFA’s research, they have it as 1.8 billion football fans with a gaming affinity) and each player’s motivations.

A diversified portfolio allows FIFA to deliver for fans in a way that no single experience ever could, and allows them to meet fans where they are - culturally, geographically, and behaviourally - while still pulling them into a shared ecosystem.

And this is where the work begins - connecting these touchpoints (experiences, data, rewards etc).

At SEG3 LA, we had a masterclass from UpTop and Avalanche on loyalty and digital identity, and in the case of FIFA (or any fan-led brand), how a unified identity later can create continuity, ownership and real insight into how fans are engaging with their IP and its wider portfolio over time.

It’s something we’ve discussed many times in this newsletter, and again in Episode 4 of The Speakeasy Podcast, because it’s foundational, and delivering it would allow value to not just be accrued to the IP, but also to their partners & ecosystem as well.

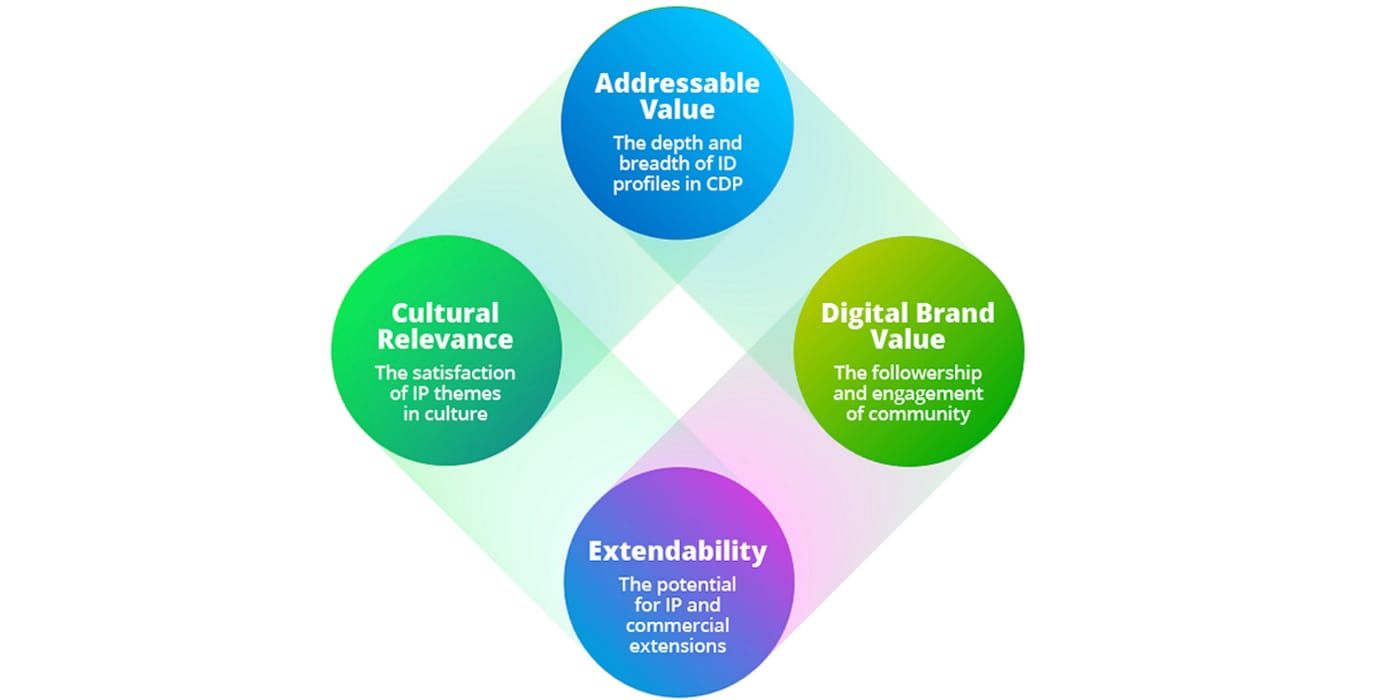

So instead of resetting every four years around a single tournament cycle, it becomes an ongoing, nurture-led process. The graphic below does a good job of showing how each pillars feeds the next ⤵️

Cultural relevance drives discovery. Digital brand value reflects ongoing fan engagement. Extendability unlocks new formats, mediums and partnerships. And addressable value is the infrastructure that allows rights-holders to understand, reward and build direct relationships with fans over time.

So, remember, in a world of infinite content and platform-led discovery, attention is easy to lose.

Fandom isn’t. That’s the superpower that sports, entertainment, gaming & music has the others do not.

Treat your IP or brand as a community asset, and it’ll be hard to go wrong.

In other news / what you might have missed over the holidays:

Global acquires majority stake in The Overlap: read here.

Nex Playground & Dude Perfect partner to bring sports gameplay: read here.

NBA & Apple to broadcast immersive LA Lakers game on Vision Pro: read here.

Twin Atlas & Makeshift bring Netflix’s K-Pop Demon Hunters to Roblox: read here.

FIFA+ app for World Cup to include real-time AR experience: read here.

Juventus launch new FAST TV channel, Juventus Play: read here.

Baller League partner with predictions market, Kalshi, for US launch: read here.

IBM & Wimbledon (AELTC) announce long-term partnership renewal: read here.

Tissot expands relationship with FIBA to become eFIBA partner: read here.

LEGO introduces Smart Play; bringing IRL creations to life: read here.

Kings League partners with Fortnite for World Cup Nations in Brazil: read here.

Wildbrain sells its 41% stake in Peanuts IP to Sony for $630m: read here.

Universal Music Group & Roblox expand partnership; focusing on merch, monetisation & artist activations: read here.

McDonald’s teams up with Crayola for co-branded activation: read here.

Netflix acquires avatar creation platform Ready Player Me: read here.

Netflix signs multi-year deal with Barstool Sports for 3 video podcasts: read here.

Ligue 1 to deliver European football first with AI-dubbed commentary: read here.

Americans are watching fewer TV shows & more free TV: read here.

DAZN expands football portfolio with rights to Kings League competitions in 2026: read here.

How PepsiCo are building a brand ecosystem inside Formula 1: read here.

Ski Federation, FIS, launches I LOVE SNOW campaign to grow fandom: read here.

Voldex partners with Peacock on holiday event in NFL Universe Football: read here.

Barrier Four bring football-themed campaign to Pls Donate: read here.

Unrivaled Basketball signs long-term deal with Cheez-it: read here.

Universal Music Group & Splice partner for AI-powered music creation tools: read here.

AI-powered sports analytics company SkillCorner announce $60m funding from Silversmith Capital Partners: read here.

Working on anything cool, or have a press release you would like us to cover? Send it in for the chance for it to be covered in next week’s edition!

What'd you think of the SEG3 Report?

That’s all for now everyone - thanks again for reading the latest edition of The SEG3 Report, and if you found it of interest, please do consider sharing with a colleague or friend!