Hey folks - welcome to Edition #44 of The SEG3 Report!

Today’s report dives into one of the world’s biggest mobile games, Monopoly GO!, partnering with Six Nations Rugby, and the potential rationale behind the collaboration — Luminate’s 2024 Film & TV Report, and the pitfalls of relying on legacy franchises, as well as Banijay Entertainment’s development of a cloud-first content ecosystem, and why they’re prioritising this as part of their digital transformation.

A quick reminder: SEG3 London is back, returning for Edition IV on 10 - 11 June. First Release passes are still available, but only until this Friday! 🏃🏻♂️💨

Right, let’s get into it!

Contents: Edition #44

Six Nations Rugby partners with Scopely’s Monopoly GO!

The collaboration, covering both the Men’s and Women’s tournaments, will offer fans unique digital campaigns, in-stadium activations, and competitions, including the chance to win VIP experiences.

Why You Should Care

TL;DR: Rugby, and traditional sports ageing audience could be a good fit for the demographic that casual mobile games are looking to target. The short ~7 week window of the Six Nations will offer Scopely the opportunity to target a European market that is lagging behind their successes in North America, as well as test out their hypothesis and see if they can acquire a customer at lower costs than other channels they’re advertising through.

In full: Monopoly GO! is undoubtedly the darling of mobile gaming at the moment - it became the fastest to hit $3 billion in mobile gaming history (in just 473 days), has over 150 million downloads and more than 10 million DAU’s.

Staggering numbers (which we covered in a little bit more detail in Edition #20), so you could be forgiven for asking why Scopely would need a sponsorship in sports, and specifically Rugby?

Well, two thoughts:

Penetration in European Markets & Trialling the Cost of Acquiring a Customer

Despite Monopoly GO!’s dominance in the US, ranking 1st for revenue, Sensor Tower’s 2024 State of Gaming Report ranked it in just 8th in Europe, with a host of games like Candy Crush & Clash of Clans from the likes of Supercell & King leading on this side of the pond.

The Six Nations, a European centric competition with primarily European viewership, clearly offers Scopely a short-term (~7 week) window to test the waters and see if they can use sports sponsorship as a more efficient acquisition tool vs traditional advertising channels.

So how much does it typically cost for mobile games to acquire a customer, and why might the Six Nations audience be fertile grounds for Scopely?

First up, customer acquisition costs (CAC) in mobile gaming.

According to FMT, the average CAC ranges between $2-10 per user - with casual/mid-core games, which Monopoly GO! would likely fit within, typically being on the upper end of that spectrum between $5-10.

But just acquiring a user doesn’t bring any guaranteed revenue to the game - with Liftoff estimating it costs approximately $35.42 for an acquired customer to make their first purchase.

So could their sponsorship of Six Nations be a more cost-effective route to acquiring users than advertising on socials and other advertising channels for Scopely?

Well, that remains to be seen – sports sponsorship packages bundle a number of things into them, so there aren’t many (if any) case studies publicly available that specifically showcase the partnership having driven significant downloads for a sponsor (if you have one, please do send it in - would love to read/cover!).

Mobile game developers are however savvy folks, and understand perhaps better than any industry the importance of acquiring customers at the right price (so their business model is sustainable), so you would however have to assume the financials for the Six Nations partnership made sense.

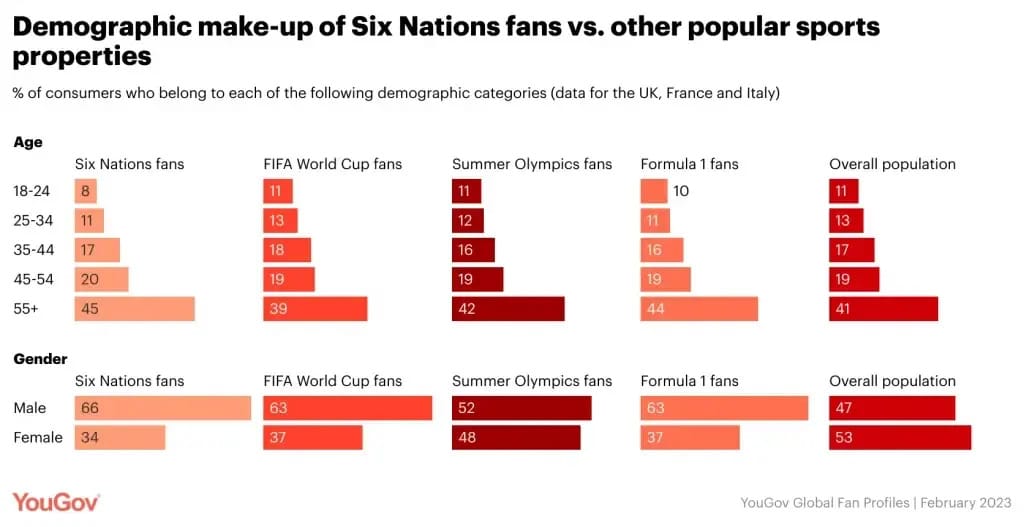

So we’ve talked about the acquisition of the customer, but what customer demographic could they be after, and how can Rugby help them to reach that?

It’s no secret that many sports brands, or any consumer facing brand globally for that matter, is pandering towards the Gen Z & A demographics in a bid to futureproof their brands.

And Six Nations are no different – they have somewhat recently partnered with Netflix for a BTS series called ‘Full Contact’, and with TikTok to drive more conversation around the tournament (in which they did get 6 billion views of content with the hashtag #SixNationsRugby in 2022).

However, the audience of Six Nations continues to be lop-sided towards a 25 and upwards audience.

For many partnerships, this would be a negative, but for Scopely & Monopoly GO!, this could well have played in their favour as according to Sensor Tower, the game typically attracts a millennial and above demographic, with only one fifth of players under the age of 25. In fact, the average player age is estimated to be 35 years old.

And that is a recurring theme for a number of casual mobile games, where the 35-54 demographic nearly rivals 18-34 year olds in playing mobile games once a week or more.

Given that, I think it likely we could see more creative partnerships like this between sports brands and mobile games over the next 6-12 months as both brands look for ways to drive revenue and acquire new customers outside of the norm.

Navin Singh, Chief Commercial & Growth Officer @ Six Nations Rugby had this to say:

“This partnership with MONOPOLY GO! is hugely exciting. The experience of the Six Nations is unlike anything else in sport, and we are always exploring ways to enhance this experience for fans. Together, we are looking forward to offering a global community of rugby fans and players of the mobile game a unique and interactive way to engage with the Six Nations beyond the action on the pitch.”

I’m certainly intrigued and will be keeping an eye to see how they activate the partnership across the next 7 weeks of the tournament. Until then, here’s to hoping for an Irish Grand Slam…

Legacy franchise sequels top the Box Office in 2024

A report by Luminate has looked at the health of TV & Film in the US, with the insights diving into the volume of TV & Film content being produced, the viewing behaviours of consumers on subscription services & the successes within the US Box Office in 2024.

Why you should care?

TL;DR: Where should you be spending your money? Producing original content has the potential to capture new audiences, but maintaining their interest is proving challenges. Legacy franchises are seeing a resurgence across SVOD platforms & the Box Office, but there are GIANT risks of losing your core audience if the storyline sways too far from the original. Less can be more in retaining attention.

In full: I hadn’t come across this report before, but it covers a lot of the key themes that we’re regularly seeing at our shows across the year – especially in Los Angeles – around the funding of new IP and whether consumers are reaching fatigue for a lot of legacy IP given the preference of studios being to take bets on longstanding franchises vs building new ones.

Is this approach stifling creativity, and allowing more global players to capture audiences attention away from the US?

The report dives into three key themes:

Impact of 2024 strikes on US TV production volume

Viewing behaviours of consumers on SVOD channels

Success of Legacy IP Sequels

A few takeaways we thought were interesting:

Netflix, despite a 22% reduction from its height of production in 2022 (190 US produced premieres), comfortably outperforms its competitors when it comes to production of original content for the platform.

They are truly a behemoth that is expanding its content set outside of traditional entertainment to other aspects of culture (with live sports and sportainment now part of their catalogue too, which we covered in Edition #41). The importance of Netflix is likely to continue growing.

But how are the original series fairing against their legacy counterparts? Well, despite large viewership of opening series, they’re struggling to maintain attention and momentum for latter releases.

So with new original content being expensive to produce and the returns not being guaranteed, do studios/SVOD platforms have more safety in funding long-running series?

Well, yes and no.

Yes as Drama series, which tend to need to be longer-term assets to be successful, did in 2024 keep pace with funding continuing alongside the averages of the past 6 years to allow series to reach the latter seasons — showing there is consumer demand for comfort and ‘what they know’.

Yes for the big screen — with legacy sequels proving to be a winner for many Box Office hits in 2024. The report also touches on the value of familiarity with an IP in helping to drive engagement, and we’re seeing more and more of this, where adaptations of video games for example, that have long-standing communities and extensive lore are becoming the primary source of film & TV content so that storytellers aren’t starting from scratch.

But No, it has not been all plain sailing when prioritising legacy IP — the report covers the Star Wars franchise, perhaps the most recognisable in history, and how the over-production of new series like The Acolyte that extended the original storyline has led to a dilution of the IP and some hardcore fans ‘switching off’.

It’s certainly a balancing act between sweating your assets/IP as much as possible to gain the most amount of value from the franchise vs an over-reliance on a singular IP as the basis for all content production, which can severely diminish the consumers connection to the franchise if it deviates too far from the original storyline.

I do however think the current environment is a bit of a poisoned chalice - and a conversation I had a few months back summarises it perfectly — if you had a $200m budget, where would you put it?

Into 40 $5m dollar shots in the dark to potentially build a new franchise, or one £200m shot with an existing audience? Where’s your biggest chance of success?

I’d suggest 9 times out 10 it is the latter, which has led to the landscape we find ourselves in today.

And it’s not a conundrum that is going to be solved anytime soon — but if consumers are pushing back on some of the strongest franchises we’ve ever known, then it should be a wake up call to all studios, platforms and media that changes need to be made fairly urgently to protect their most popular IPs and take more calculated risks on production to maintain relevance.

Banijay Entertainment developing cloud-first content ecosystem with base & AWS

The partnership aims to build a unified, cloud-based content ecosystem that improves creativity, operational efficiency, and revenue generation. Banijay will migrate its vast content catalog to the cloud, making it more accessible and secure, while enabling global collaboration for its international teams, with AWS's services streamlining content management and opening new distribution channels.

Why you should care

TL;DR: Using emerging technology to improve operations and become more efficient is often undervalued vs using the same technologies to create new products/experiences. A pound is a pound whichever way it comes about. Banijay have a clear north star of where they want to take their business, and are smartly leveraging AI & Cloud technology to futureproof their internal infrastructure and make themselves more nimble to compete in today’s busy landscape.

In full: For those of you who attended SEG3 London last summer, you’ll have had the opportunity to listen to Banijay’s Chief Digital and Innovation Officer, as well as base’s CEO, both discussing marrying up organisational strategy with technological implementation, and this announcement is certainly the synthesis of that conversation.

Banijay Entertainment is perhaps one of the lesser known giants of entertainment, being home to over 130 production companies across 21 territories and a catalogue boasting over 200,000-hours of original programming which includes the likes of Big Brother, Peaky Blinders, MasterChef & more. Alongside this, and relevant to the discussion in the previous segment, they also launched 70+ new scripted titles and 200+ new non-scripted shows in 2023, which is a sizeable undertaking covering many different genres, formats & audiences.

And managing that amount of content would be a challenge for any organisation, which is why this partnership, leveraging AI & Cloud technologies is interesting as they’re about to embark on three steps towards digital transformation, which’ll include:

Cloud Migration = better access to content for global teams

Content Hub Creation = indexed content offers more accessibility & insights

Media Workflow Transformation = helps to unlock new revenue streams through partnerships & licenses

Rethinking the production and distribution pipeline to weed out inefficiencies might not be the sexiest topic, but when it comes to transforming behemoth businesses, like many media & entertainment businesses are, prioritising changes that will improve the speed of the organisation will help them to compete with the more nimble content producers and creators that are taking a lot of eyeballs away from their programs and platforms.

After all, keeping pace with culture is vital for any brand to be part of the conversation and keep connection with their consumers.

In other news this week…

Aston Martin Aramco F1 & TikTok announce winners of creator talent search: read here.

Nielsen to end ‘panel-only’ ratings which have measured TV for decades: read here.

Netflix & LEGO team up for One Piece playsets: read here.

Deloitte released 2025 Tech Trends report: read here.

The Olympic Esports Games have been delayed: read here.

DC’s Justice League & SEGA’s Sonic team up for five issue comic book series: read here.

Arsenal use ultrasonic sound for lights display: read here.

Hugo Boss launches AI-powered product content live on e-commerce platforms: read here.

Google pays $250m for HTC XR IP and employees: read here.

Learnings from the FTC’s settlement with Genshin Impact: read here.

Ubisoft shuts down studio in Leamington, with 185 redundancies: read here.

Bentley Motors partners with Voldex for Driving Empire: read here.

F1 reveals Hot Wheels collection: read here.

Working on anything cool, or have a press release you would like us to cover? Send it in for the chance for it to be covered in next week’s edition!

That’s all for now folks - thanks again for reading the latest edition of The SEG3 Report and we’ll see you next Tuesday for more on the intersection of culture & emerging technology!